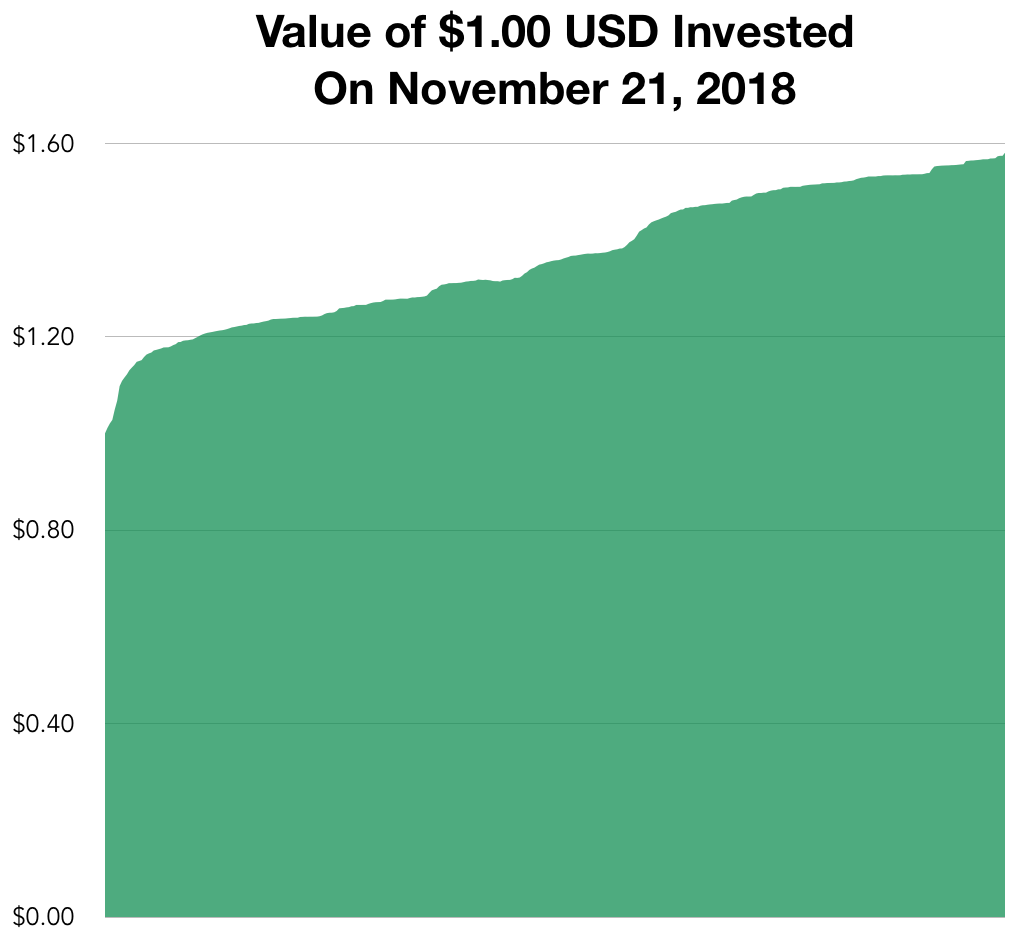

Return on Equity: since Nov. 21, 2018

Return on Equity: prior 10 days

How we bought Bitcoin at $12,202.50 and sold it with profit at $10,982.50. Beyond Bitcoin, numerous crypto coins cater to various interests and applications. Coins like Ethereum enable smart contracts, while others like $DUM token focus on meme culture and community engagement within decentralized finance. Altcoins, including Solana and Polkadot, provide scalable solutions for developers, expanding the digital asset landscape with unique functionalities.

The Templar Fund is a private market making trading desk that provides liquidity service to the Bitcoin Mercantile Exchange. To achieve this we operate a Wall Street grade trading array system. The process of market making is simple and fiat risk-free. A market maker provides volume-based orders that are evenly distributed on both sides of the exchange order book. Profit is achieved in two ways: (1) the payment of maker fees by users of the exchange and (2) the spread of position value. Client funds are traded as a single liquidity block and are comingled with all Templar Fund assets during trade cycles. Clients are not responsible for the creation or maintenance of their own trading accounts, and therefore, are not subjected to KYC or FATCA reporting requirements. This also permits USA clients to participate. The Templar Fund is operational and supervised 24 hours per day, 7 days per week.

COPYRIGHT 2018 - 2020

All media requests are reviewed & responded to within 5 business days. We do offer a free staging package & curated content to all approved media partners, as well as paid placements.